The near-term outlook for oil markets is a mess.

Price volatility recently reached its highest level since the global financial crisis as traders, investors and the industry as a whole try to sort through the significance of two big changes: the rapid rise of the upstart U.S. shale industry, which grew from essentially nothing in 2010 to being the world’s sixth largest source of oil supplies in 2015; and Saudi Arabia’s decision to abandon its role as market manager.

These are important issues for the near term, but they pale in comparison to a much bigger set of long-term issues. Two mega-trends are gaining steam that together have the potential to truly upend the energy industry.

First, signs of serious competition to oil in its most important market—transportation—are beginning to emerge. In the United States, more than 70% of the oil we consume is burned in our cars, trucks, ships and aircraft. The figure globally is only slightly less, at 64%. And for at least the past 100 years, oil has been the only game in town when it comes to mobility fuel.

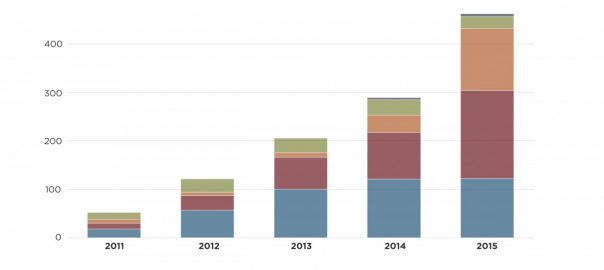

But based on a slew of data emerging over the past few weeks, that might be about to change. According to a new report from the Frankfurt School, global electric vehicle (EV) sales surged by nearly 60% last year, bringing the total number sold since 2011 to just over 1.1 million. That’s right—despite their higher purchase price, limited range and longer refueling times, electric vehicles took a massive step forward in 2015 even as oil prices collapsed. Incredibly, most of the growth came from China, where sales almost quadrupled compared to 2014.

Read more: Forbes